Public Benefit Corporation Reporting Requirements

Benefit Corporation Reporting Requirements. When creating a benefit report benefit corporations must consult state requirements and choose a third party standard.

Most states benefit corporation laws as well as B Lab certification requirements require public disclosure of benefit performance according to third-party standards and certification of those benefit reports is essential to increase their credibility among investors and the business community.

Public benefit corporation reporting requirements. Notification Requirements for California Public Benefit Corporations. All benefit corporations are required to create a public benefit report each year. A public benefit corporation cannot distribute profits gains or dividends to any person.

The School which is part of the States education program is. Every year a public benefit corporation must file with the secretary of state an annual benefit report covering the previous 12-month period. However a public benefit corporation is not liable for monetary damages for any failure to pursue or create a public benefit whether general or specific.

P Public benefit corporation means a corporation that is recognized as exempt from federal income taxation under section 501c3 of the Internal Revenue Code of 1986 100 Stat. In Benefit Corporations. Alternatively the company can send the report at the same time it sends any other annual reports to its shareholders this option may be easiest for most companies.

1 as amended or is organized for a public or charitable purpose and that upon dissolution must distribute its assets to a public benefit. For the creation of benefit corporations Ohios proposed legislation differs from that adopted in some other states due to its flexibility. Some state laws require each benefit corporation to produce an annual public benefit report prepared against a third-party standard that describes how and to what extent the corporation has accomplished its beneficial purpose.

Senate Bill 21 gives shareholders the flexibility to determine what if any public reporting would be required. You can find additional information about filing requirements and exceptions on our website at Charities--Non-Profits under Annual Reporting Filing. Ongoing compliance and reporting requirements.

Under California law a public benefit corporation must be formed for public or charitable purposes and may not be organized for the private gain of any person. The focus is on both profit and mission alignment. States generally have some form of public reporting and governance requirements for benefit corporations aimed generally at telling shareholders how the company is doing in meeting its public benefit objectives including for example.

To meet the transparency provisions of benefit corporation legislation all benefit corporations are required to create a benefit report. Further while the DGCL provides that a corporation can include the requirement that this report i be prepared more frequently than biennially ii be made available to the public andor iii be reviewed and validated by a third-party PBCs are not required to do so under the default rules. Some state laws require each benefit corporation to produce an annual public benefit report prepared against a third-party standard that describes how and to what extent the corporation has.

Public benefit corporations often qualify for exemption from income tax. Name of each person that owns 5 or more of the companys outstanding shares. The company is required to send the benefit report to each shareholder within 120 days following the end of the fiscal year.

Change of Address Name MissionSpecific Purpose Scope of Activities or Other Significant Changes to Bylaws A California nonprofit may wish to make changes to the organization that could have tax and legal consequences. Is an Ohio Public Benefit Corporation established pursuant to Ohio Revised Code Chapters 3314 and 1702 to address the needs of students in grades 9 through 12. What Directors Must Report we explained that these hybrids must measure their successes and failures against a consistent third party standard each year and disclose the results in a mandatory annual report.

Note that in Delaware it does not need to be released to the public or to use a third party standard as an assessment tool however it is considered best practice to do both. A public benefit corporation is a corporation created specifically to benefit the public in some way. If the board determines that the benefit corporation failed to pursue its public benefit purpose it should include a description of the ways in which the corporation failed.

Therefore describe the specific filing exception you meet. The benefit report must also include a statement by the board of directors indicating whether in its opinion the corporation failed to pursue its public benefit purpose in all material respects. Most organizations are required to file Form 990 990-EZ 990-N or 990-PF.

The attached audit report was completed and prepared for release prior to the commencement of. This corporation is organized and operated exclusively for charitable purposes within the meaning of Sections 501c3 and 509a2 of the Internal Revenue Code pursuant to the provisions of the Nonprofit Public Benefit Corporation law of the State of Ohio. Creates extra options when.

Is Any Type of Reporting Required. Missing Schedule X 25. A benefit corporation preserves a companys mission in the following ways.

Can Can Wonderland On Twitter Benefit Corporation Canning Wonderland

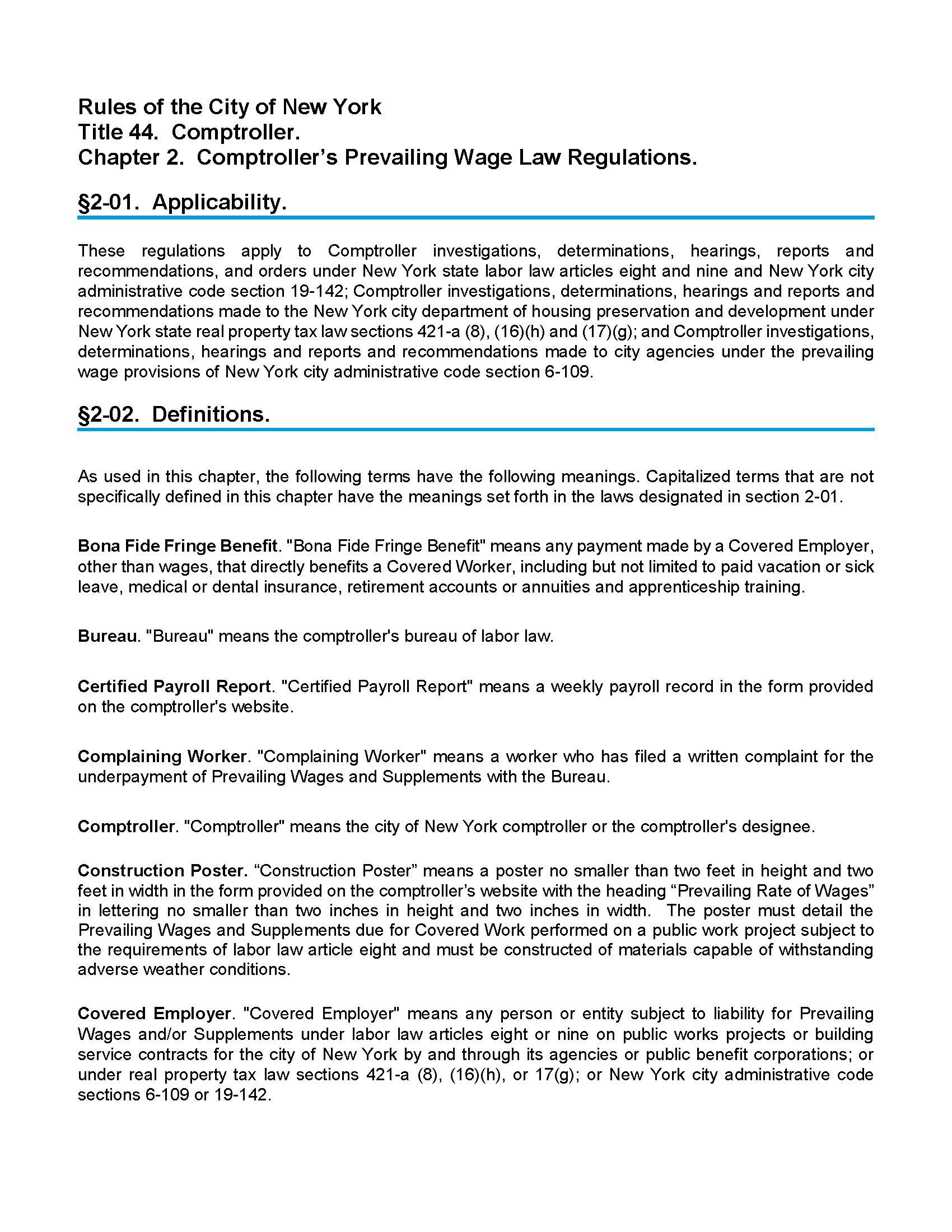

Wage Schedules Office Of The New York City Comptroller Scott M Stringer

Pin On Demandblue Salesforce Blogs

The Difference Between Certified B Corps And Benefit Corps Business Structure Benefit B Corporation

New Guidebook Helps States Create Better Businesses Benefit Corporation Environmental Law Business Leader

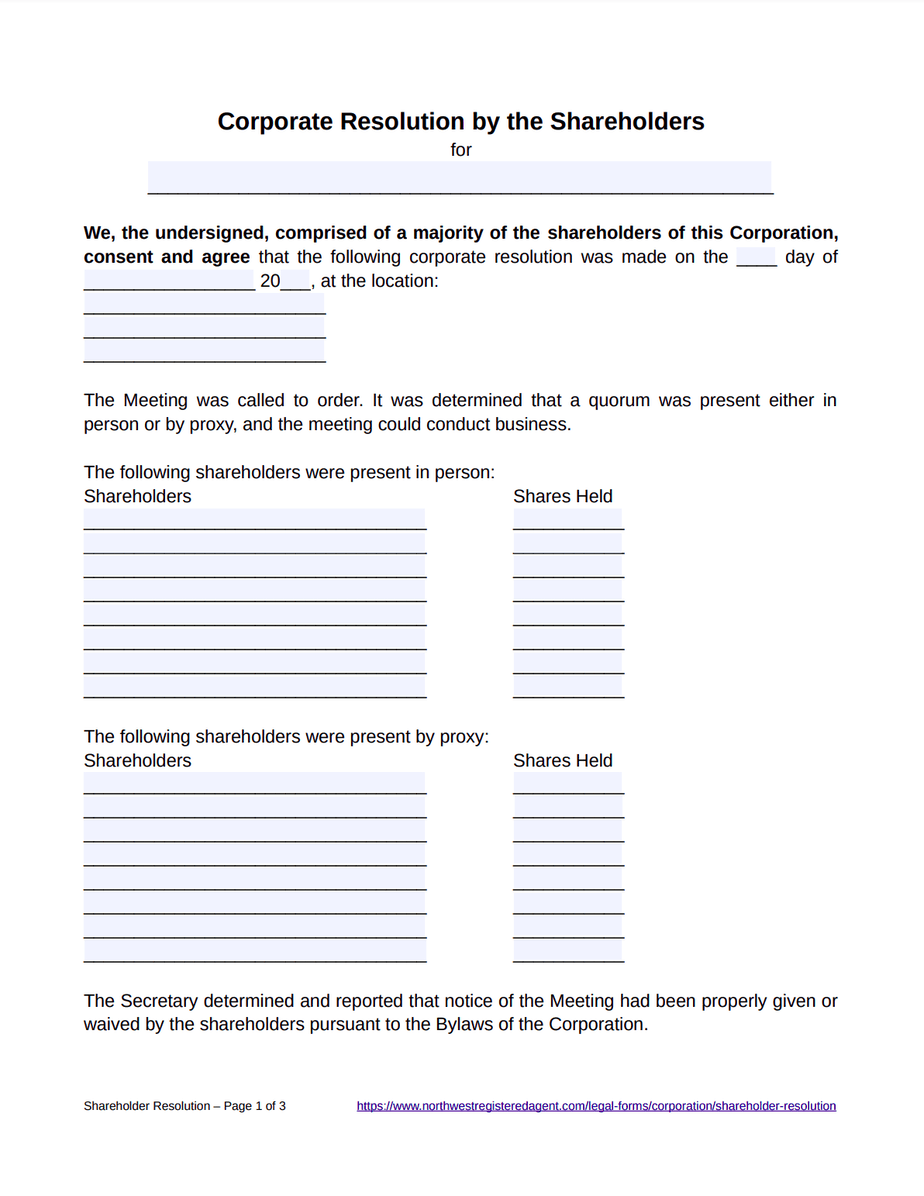

Shareholder Resolution Free Template

5 Things You Need To Know Before Incorporating A Business Legalzoom Com

12 Reasons And B Corporation Certification Benefits For Social Entrepreneurs Social Entrepreneur B Corporation Benefit Corporation

Pin On Influential Business Brand

Annual Reports Target Corporation

15 Key Steps To Set Up A Charity

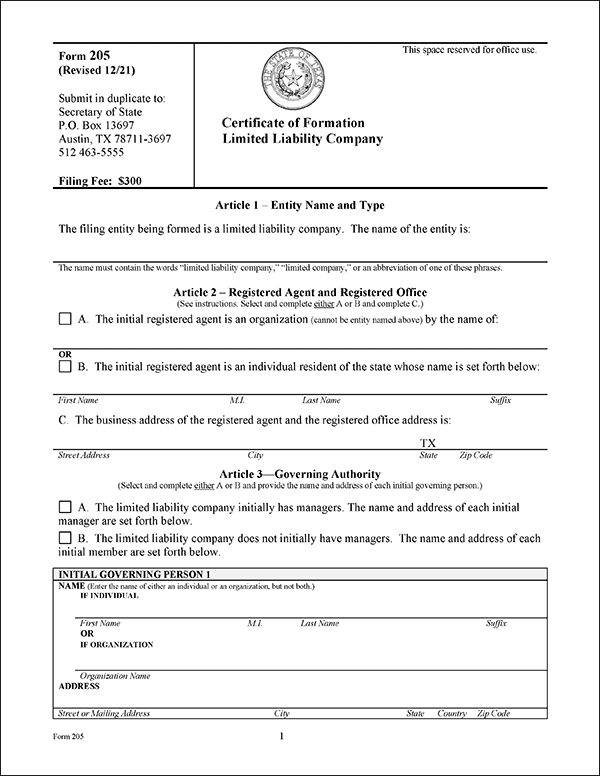

Llc In Texas How To Start An Llc In Texas Truic

Pin On Social Entrepreneurship And Innovation

Start A Non Profit File A 501c3 Non Profit Corporation Sundoc Filings

Post a Comment for "Public Benefit Corporation Reporting Requirements"