Student Loan Forgiveness Bill Passed

He has expressed support for 10000 in student loan forgiveness but recently came out against 50000 in student loan forgiveness proposed by Democratic lawmakers and student loan. Biden has consistently expressed support for broad student loan forgiveness but has favored a more targeted approach coming out in favor of 10000 in across-the-board debt.

Menendez And Pascrell Urge Biden To Move On Student Loan Forgiveness Insider Nj

Public Student Loan Forgiveness Elimination In the spending bill passed by Congress in March 2018 to fund the government through September Congress went against many of the Trump administrations budget proposals including doing away with.

Student loan forgiveness bill passed. Tax-Free Student Loan Forgiveness is Part of the Latest Covid-19 Relief Bill The recently passed American Rescue Plan ARP Act of 2021 includes a provision making nearly all student loan forgiveness tax-free at least temporarily. People with loans from private institutions would not be affected The American Rescue Plan Act of 2021 passed this month allows canceled student loan debt to. Oct 23 2018 President Signs Bill Offering Student-Loan Debt Forgiveness for Substance-Use-Treatment Staff President Donald Trump signed a bill on October 24th that addresses the opioid crisis and provides forgiveness for student loans of up to.

The clause included in the 19 trillion bill that President Joe Biden signed into law on Thursday ensures that student loan borrowers who see their debts wiped out in. Repayment on federal student loans was initially paused as part of the Coronavirus Aid Relief and Economic Security Act CARES a 22 trillion economic stimulus bill in response to the COVID-19 induced economic recession passed on March 27 2020. Covid-19 Relief Bill Passes With Tax-Free Student Loan Forgiveness The US.

One of the amendments adds tax-free student loan forgiveness to the House version of the bill. Roughly 43 million Americans owe a collective 159 trillion in federal student loan debt and if Schumers proposal ever passed that would wipe out all existing student debt for nearly 837. The released version of.

This provision builds on a tax provision included in the 2017 tax bill that Republicans passed which scrapped tax liability for student debt forgiven because of disability or death. However its possible that President Biden may act via executive order as has been his proclivity in the first weeks of his presidency. Student Loan Forgiveness Usually Taxable Is Tax-Free Under the Relief Bill Federal laws generally treat any forgiven student loan debt as a taxable event for the borrower subject to a couple of exceptions like for Public Service Loan Forgiveness as well as disability discharges until January 1 2026.

On March 11 2021 President Biden signed the American Rescue Plan Act of 2021 into law. The 19 trillion Covid-19 relief legislation passed by the US. S2463 Strengthening Forgiveness for Public Servants Act Sen.

Senate passed an amended version of the American Rescue Plan Act of 2021 on Saturday March 6 2021 by a vote of 50 to 49 along political lines. Student Loan Relief Provided by the HEROES Act House progressives had originally pushed for 30000 in across-the-board student loan forgiveness. Washington March 10 2021.

McDermott Proportional Public Service Loan Forgiveness. To benefit from PSLF you should repay your federal student loans under an income-driven repayment plan. Today the House of Representatives passed the American Rescue Plan Act including legislation introduced by Congressmen Jimmy Gomez CA-34 Bill Pascrell NJ-09 and Senator Bob Menendez D-NJ that makes any student loan forgiveness tax-free.

Tax Free Income-driven Repayment Plan Forgiveness. The American Rescue Plan Act of 2021 passed in the Senate on March 6 2021 by a vote of 50 to 49 along party lines. HR2429 Student Loan Tax Debt Relief Act Sen.

This transformative legislative package will now head to the White House for. By Mark Kantrowitz. Included in the bill is a provision that would make student loan forgiveness passed between Dec 31 2020 and Jan 1 2026 tax-free.

President Biden has expressed a desire to have any form of student loan forgiveness to be a law that is passed by both houses of Congress. If you work full-time for a government or not-for-profit organization you may qualify for forgiveness of the entire remaining balance of your Direct Loans after youve made 120 qualifying paymentsthat is 10 years of payments. Before the ARP student loan forgiveness was tax-free only under special programs.

Senate makes all student loan forgiveness tax-free.

Trump Interested In Extending Suspension Of Student Loan Payments As Advocates Warn Economic Crisis Has No End In Sight Marketwatch

Student Loan Forgiveness For Frontline Health Workers Act 2020 116th Congress H R 6720 Govtrack Us

Experts Predictions On Student Loan Forgiveness Nextadvisor With Time

Student Loan Forgiveness Is Tax Free In New Stimulus Bill 9news Com

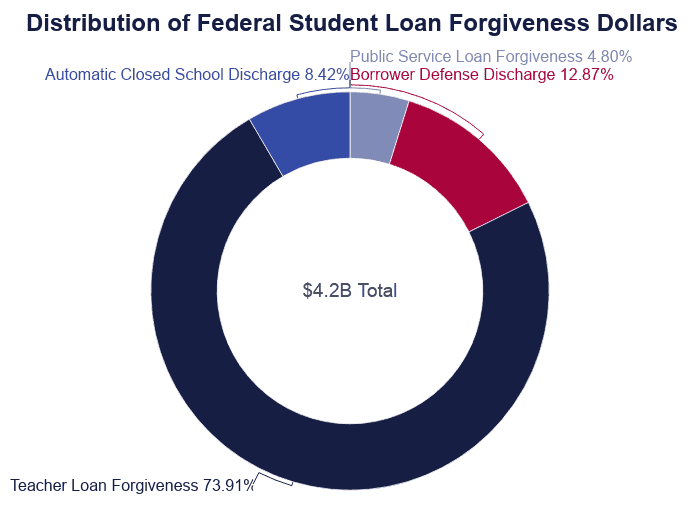

Student Loan Forgiveness Statistics 2021 Pslf Data

2020 Guide To Obama Loan Forgiveness Can It Help You Fsld

What To Do If Student Loan Forgiveness Isn T In Next Stimulus Bill

Consumer Groups Slam Gop Stimulus Bill For Failing Student Loan Borrowers

Biden Excludes Student Loan Forgiveness From Budget Proposal But Calls For More Funding For Higher Ed Key Details

Student Loan Forgiveness Unlikely In Next Stimulus

6 New Developments Offer Clues On Student Loan Forgiveness

What To Know About The Debate Over Student Loan Forgiveness Npr

Student Loan Debt Relief Program Made Easy As Covid 19 Relief Ends

Here S What The Stimulus Does And Does Not Do For Student Loan Borrowers

Biden Thinks Student Loan Debt Relief Is Up To Congress That S A Good Thing

House Passes Biden S Massive Stimulus Bill What It Means For Schools Student Loan Borrowers

Biden Calls For Student Loan Forgiveness And Free College

Post a Comment for "Student Loan Forgiveness Bill Passed"