Cumberland County North Carolina Property Tax Bill Search

Enter the entire bill number like this. We have placed a new secure outdoor drop box beside the mailboxes in the Judge E.

Vehicle Property Tax Receipts Available On Official Ncdmv Website Bladenonline Com

Look up your bill using any of the search options listed.

Cumberland county north carolina property tax bill search. Maurice Braswell Cumberland County Courthouse back parking lot off Cool Spring and Russell Streets. For the fiscal year 2018-2019 the tax rate is 046 per 100 of property valuation with an additional 005 per 100 of property valuation. Tax Year Please select criteria.

These bill numbers are 5-10 digits long and begin with the year of the bill. Cumberland County NC Property Tax Search by Address. Add the desired bill to your cart and continue through the payment process.

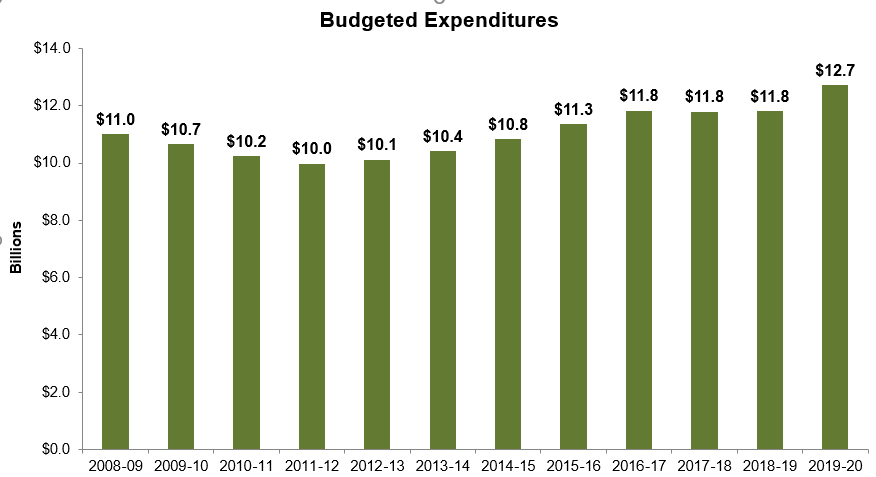

See what the tax bill is for any Cumberland County NC property by simply typing its address into a search bar. For questions regarding the Streamside Subdivision assessment Matthews jurisdiction only please call. The chart on the 2020 tax bills addresses all categories of expenditures included in the FY21 adopted budget.

Cumberland County Tax Records North Carolina httpwwwcocumberlandncustaxpayments Search Cumberland County tax bills by last name tax year business name andor bill number. All Years 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011. County-Related Services Tax BillsReal Estate Data Search For questions related to data found in tax bill and property searches contact the Cumberland County Tax Administration Department at taxwebcocumberlandncus or call 910 678-7507.

For questions concerning the properties listed above please contact Ashley Jackson at Johnson Johnson Attorneys at Law PLLC 910 862-2252. Vehicles are also subject to property taxes which the NC. When sending your request for exemption please provide your Tag and or a copy of your tax bill.

Tax Administration has added another contactless option for making check or money order tax payments and for submitting tax listings and forms. Click the Pay Tax Bill button below to go to Fortes payment website. 2020 Property Tax Bills Correction.

Do not include street type eg. Cumberland County Tax Warrants httpwwwcocumberlandncusdepartmentslegal-grouplegaltax-foreclosure-sales Find Cumberland County North Carolina tax warrant and lien information by. Cumberland County Tax Records North Carolina Report Link httpwwwcocumberlandncustaxpayments Search Cumberland County tax bills by last name tax year business name andor bill number.

Union County taxpayers recently received their 2020 property tax bills. Bills are calculated based on the tax rate that is established by the Hope Mills Board of Commissioners during the annual budget process. Open Property Tax Bill Search in new window If you have questions on your tax bill please call 311 or dial 704-336-7600 if outside Mecklenburg County limits.

See Cumberland County NC tax rates tax exemptions for any property the tax assessment history for the past years and more. You may also e-mail your LES and documents to. Bills received after September 30 2010 have bill numbers in the new BILL NUMBER format.

The Cumberland County Tax Administration Department handles all assessment valuation billing and collection of property taxes for the Town of Hope Mills. Bladen County Courthouse door at the noted date and time. Cumberland County Tax Administration PO Box 449 Fayetteville NC 28302 or fax to 910-678-7582.

Division of Motor Vehicles collects as defined by law on behalf of counties Revenue from the highway-use tax goes to the North Carolina Highway Trust Fund and the North Carolinas General Fund and is. In-depth Property Tax Information. Rd Dr or street directions eg.

Historically a footnote and chart included on the tax bill have provided a categorical breakdown of only general fund expenditures. Please select criteria. Other dependents are NOT exempt.

The Tax Department is required to provide information research and maintain records. To view and manage details about your driver license and vehicle registration including payment receipts use MyDMV Portal. These bill numbers are in this format.

The Tax Department is responsible for obtaining developing analyzing and maintaining records necessary for the appraisal assessment billing collection and listing of taxes associated with real and personal property within the jurisdiction of the county and municipalities according to the state of North Carolina General Statutes.

Free North Carolina Name Change Forms How To Change Your Name In Nc Pdf Eforms

Property Tax Revaluations Coming Up For 24 North Carolina Counties Bell Davis Pitt

Directory Of The State And County Officials Of North Carolina State Publications I North Carolina Digital Collections

North Carolina Property Tax Records North Carolina Property Taxes Nc

Carolina Comments 2011 April State Publications I North Carolina Digital Collections

Directory Of The State And County Officials Of North Carolina State Publications I North Carolina Digital Collections

North Carolina Sales Tax Small Business Guide Truic

North Carolina Economic Development Guide 2021 By Business North Carolina Issuu

North Carolina Memory Digitalnc

County Budget And Tax Survey North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

187 Front Page 1 30 Normalize North Carolina Court System

Property Tax In North Carolina John Locke Foundation John Locke Foundation

Directory Of The State And County Officials Of North Carolina State Publications I North Carolina Digital Collections

Supreme Court North Carolina Court System

Nc Property Tax Revaluation Page 4 Bell Davis Pitt

North Carolina Property Tax Records North Carolina Property Taxes Nc

North Carolina Property Tax Solution Optimize The Property Tax Process North Carolina Association Of County Commissioners

North Carolina Historical Review 1932 July State Publications Ii North Carolina Digital Collections

Post a Comment for "Cumberland County North Carolina Property Tax Bill Search"