Public Benefit Corporation Irs

The focus is on both profit and mission alignment. This key distinction underlies many of the advantages of forming a PBC.

A public benefit corporation is a corporation formed to benefit the general public.

Public benefit corporation irs. Yes the benefit corporation form was designed to protect the mission of a company when it goes public. First it confirms that payments made to a charity may be fully deductible as a business expense rather than. Public Benefit Corporation Overview.

Some state laws require each benefit corporation to produce an annual public benefit report prepared against a third-party standard that describes how and to what extent the corporation has accomplished its beneficial purpose. In February 2017 Laureate Education the largest degree-granting higher education institution in the world became the first benefit corporation to go public with an Initial Public Offering IPO. Senate Bill 21 gives shareholders the flexibility to determine what if any public reporting would be required.

This is newsworthy for two principal reasons. What the benefit corporation entity form adds to charitable organization for-profit structuring that was not available before its inception is an entity option that includes an external publically declared mission opportunity as well as a built-in transparency and disclosure system that is robust enough to provide a charitable organization and the public with insight into the operations of a for-profit business. Public benefit corporations also known as benefit corporations are for-profit businesses whose charters commit them to social or environmental.

Benefit corporations now have a tax advantage over an average C Corporation since these contributions can now be. IRS Says Benefit Corporations May Treat Payments to Charity as a Business Expense. The following is a list of other types of tax-exempt organizations.

Unlike a nonprofit organization a public benefit corporation PBC can pursue a public benefit purpose while also engaging in profit-generating activities. P Public benefit corporation means a corporation that is recognized as exempt from federal income taxation under section 501c3 of the Internal Revenue Code of 1986 100 Stat. These corporations take into account how other stakeholders such as communities and the environment will be affected by their actions.

The IRS just released Information Letter 2016-0063 confirming that a benefit corporation may deduct payments to charity as an ordinary business expense. In a General Information Letter dated June 2 2016 the Internal Revenue Service IRS announced that a benefit corporation can deduct contributions to charities as business expenses when the payments are for institutional or goodwill advertising to keep the corporations name before the public. If you formed as a mutual benefit corporation in error please file an amendment to your Articles of Incorporation to change to a public benefit corporation.

Creates extra options when. 1 as amended or is organized for a public or charitable purpose and that upon dissolution must distribute its assets to a public benefit. A benefit corporation preserves a companys mission in the following ways.

Public benefit corporations also known as benefit corporations are for-profit businesses whose charters commit them to social or environmental missions not just maximizing shareholder value. A public benefit corporation is a corporation created specifically to benefit the public in some way. These organizations contend with a variety of obstacles from managing not-for-profit regulatory compliance issues to establishing fundraising foundations navigating IRS and state attorney general oversight and securing public funding sources.

For more information regarding these types of organizations download Publication 557 PDF Tax-Exempt Status for Your Organization or contact IRS Customer Service. A nonprofit public benefit corporation refers to a charitable organization that is advantageous to the general public meaning that anybody can benefit from its actions. Beneschs Not-for-Profit Team counsels and represents a wide range of not-for-profit organizations.

Corporations Organized Under Act of Congress including Federal Credit Unions. Such a corporation usually participates in activities related to social services health education the arts and other fields that can enhance the quality of life of people in its community.

The Act Allows Flow Through Businesses In New Jersey Such As Sub S Corporations Partnerships Llcs Or Sole Proprietors Tax Deductions Income Tax Tax Services

Irs Ein Online Application Know The Benefits And Make Your Application Business Bank Account Filing Taxes Irs

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

Llc Taxed As C Corp Form 8832 Advantages Disadvantages Llc University

Benefit Corporations What You Need To Know

Pin On Fillable Pdf Forms And Templates

The Internal Revenue Service Irs Recently Released A Checklist To Help Public Employers Comply With The Fringe Be Employee Benefit Fringe Benefits Employment

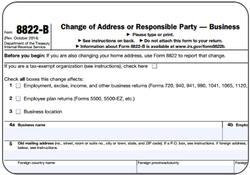

What Is Irs Form 8822 B Harvard Business Services

Non Profit Corporation Vs Public Benefit Corporation Harvard Business Services

Pin On Advantages Of 501c3 Tax Exempt Status

Pin On Tips Tools For Nonprofits

Non Profit Corporation Vs Public Benefit Corporation Harvard Business Services

Irs Grants One Day Extension After Website Suffers Technical Difficulties On Tax Day Tax Day Irs Income Tax

Post a Comment for "Public Benefit Corporation Irs"