Student Loan Forgiveness Keiser University

But each student should return student debts. The Keiser University Alumni Association exists to keep each and every one of YOU connected to each other and to Keiser University.

This amount includes both private and federally-funded student loans.

Student loan forgiveness keiser university. These loans have low interest rates and. Keiser University participates in the federal student loan program which allows students and their parents to borrow money to help meet their educational costs. If you are a student misled and defrauded by the university there are closed for-profit school student forgiveness programs such as Borrower Defense to Repayment to discharge your student loans.

Note that there is some misleading information that students of Keiser University should not pay their mortgages. Teacher Loan Forgiveness If you teach full-time for five complete and consecutive academic years in certain elementary or secondary schools or educational service agencies that serve low-income families and meet other qualifications you may be eligible for forgiveness of up to a combined total of 17500 on eligible federal student loans. Former students claim the school misled them into enrolling for useless programs by giving them inaccurate information about their credit transferability program costs accreditation status and the terms on financial loans.

They helped me in a moment that I believed there is no way to get out of my student loans. Student Loan Forgiveness Defined. Therefore if you also were a student of Keiser and have a loan you can benefit from student loan forgiveness.

Keiser University is Floridas second largest not-for profit private university serving a high population of Florida residential students. Learn more about our one-time payment and payment plan options for your past due or unpaid tuition and. GO Manage Unpaid Tuition Fees.

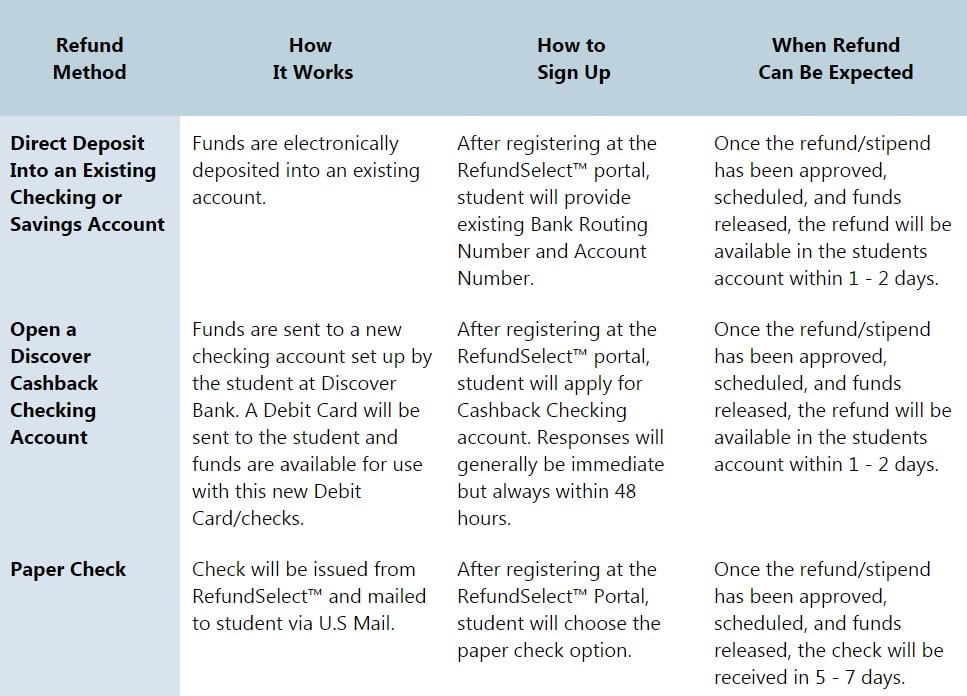

As the Department of Education announced borrowers may get partial loan forgiveness depending on their income. Lender terms and eligibility change from time to time and while all the lenders listed below currently provide loans to our students. Keiser University provides an exclusive service for students with Direct Stafford Subsidized or Unsubsidized loan s through a relationship with the i3 Group.

Both independent students and their parents can borrow debt for their college tuition. They may not always do so. Keiser University loan forgiveness is the part of the federal student loan forgiveness program which allows students and their parents to pay their student loans back.

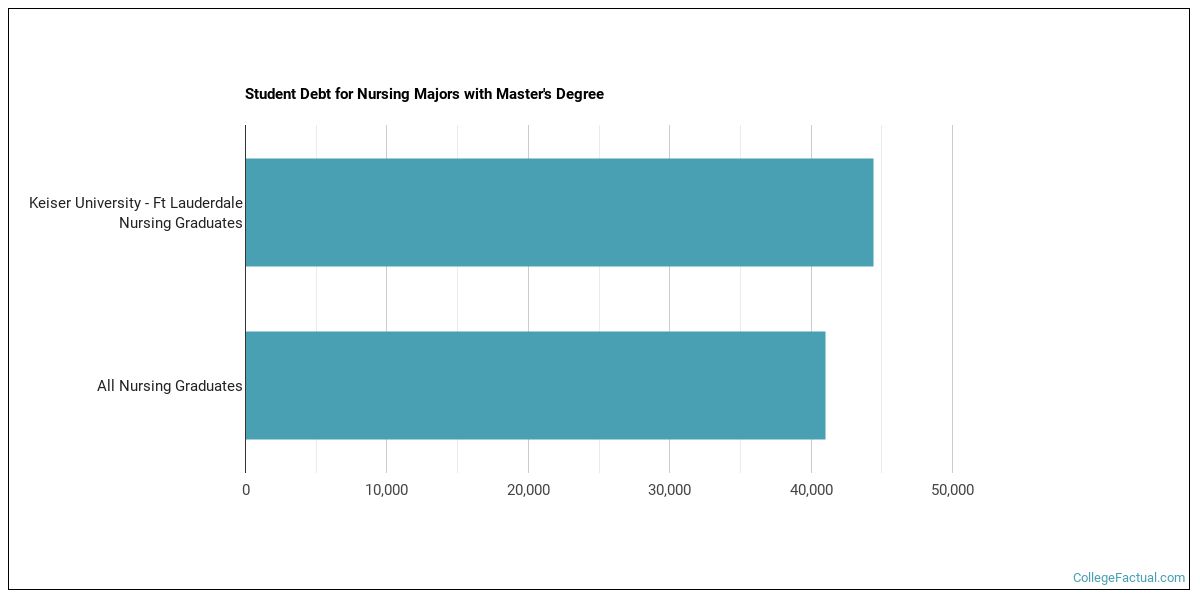

Familiarizing yourself with the terms of your loan s as well as your rights and responsibilities will help you better manage your student loan debt. The Financial Aid Department at Keiser University provides assistance to students who need financial aid in order to pay tuition expenses at the University. Freshmen At Keiser University - Ft Lauderdale Take Out an Average of 13577 in Loans in Their First Year.

A substantial part of Keiser University Financial Aid programs is student loans. Not sure what to expect with your student loans. As one of the conditions is proving the mismanagement of the organization you will be advantageous in your claim.

After all youre not just a Seahawk during your college years youre a Seahawk for life. Keiser University does not make any recommendations regarding lender selection. History of Keiser University Class Action Lawsuit Keiser University has been a controversial educational center since 2010.

Password is case sensitive. Explore our help center to see important information that will help you navigate while you are in-school through repayment. Differently from grants you should repay the loan amount with interest.

Educational loans MUST BE PAID BACK with interest. Keiser University has come to an agreement with Florida Attorney General Pam Bondi in regards to claims of fraud at its Fort-Lauderdale campus. Learn About Your Student Loans.

Thanks to all professionals of Forget Student Debt. At Keiser University - Ft Lauderdale 720 of incoming students take out a loan to help defray freshman year costs averaging 13577 a piece. The Financial Aid Department has established procedures which assure fair and consistent treatment of all applicants.

To reset student account password click hereclick here. Now that they have defaulted and are in the debt collectors hands I was given advice to go find someone to approve me of a 15000 loan so that I can pay off the debt collector in full just pay the loan. Private student loans should only be considered after applying for federal financial aid.

Before taking a loan you should pay attention to the interest rates and payment terms of it. With an average of 28950 of debt per borrower for a total of four years according to the same. These loans are from University Accounting Service LLC the 10000 is from Keiser University the other is from Everglades College Inc.

They brought me from a time that I faced a problem of losing my home to a moment that I save around 48000 in total.

How To Get Rid Of Student Loans In 2020 Eliminate Your Debt Fsld

Pin On Interesting Infographics

Financial Services Keiser University

Keiser University Fraud Complaints Www Challengestudentdebt Com

Keiser University Class Action Lawsuit Student Loans Resolved

The Nursing Major At Keiser University Ft Lauderdale College Factual

Keiser University Class Action Lawsuit Student Loans Resolved

Keiser University Student Loan Forgiveness Student Loan Resolved

Keiser University Student Loan Forgiveness Student Loan Resolved

Keiser University Student Loan Forgiveness Student Loan Resolved

The Nursing Major At Keiser University Ft Lauderdale College Factual

I M Sinking In Debt After Graduating From Keiser University

Financial Services Keiser University

Keiser University Student Loan Forgiveness Student Loan Resolved

Keiser University Ft Lauderdale Loan Debt Loan Default Rates

Post a Comment for "Student Loan Forgiveness Keiser University"