Public Benefit Corporation Tax Filing

That makes filing taxes for a mutual benefit corporation much like filing taxes for a regular corporation. 302 Public Benefit National School Art Collective is designated as a public benefit corporation.

How The Tcja Tax Law Affects Your Personal Finances

Because most mutual benefit corporations do not benefit the general public they lack a charitable or religious purpose.

Public benefit corporation tax filing. However this corporate status does not automatically grant exemption from federal income tax. Nonprofit Domestic Corporation Filing Fee. Section 35-2-126 of the Montana Code Annotated MCA requires that an organization must be designated as a mutual benefit public benefit or religious corporation as determined by the articles of incorporation filed with the Secretary of States Office.

1 as amended or is organized for a public or charitable purpose and that upon dissolution must distribute its assets to a public benefit. Most states require that the report be completed annually and made available publicly. You are incorporated as a mutual benefit corporation.

By a corporation exempt from federal income tax as an organization described by Section 501 c3 of the Internal Revenue Code or the. In addition benefit corporations must file a benefit report that uses a third-party standard such as B Lab to assess the companys performance with regard to its public purposes. Certification Fee - 500 Note.

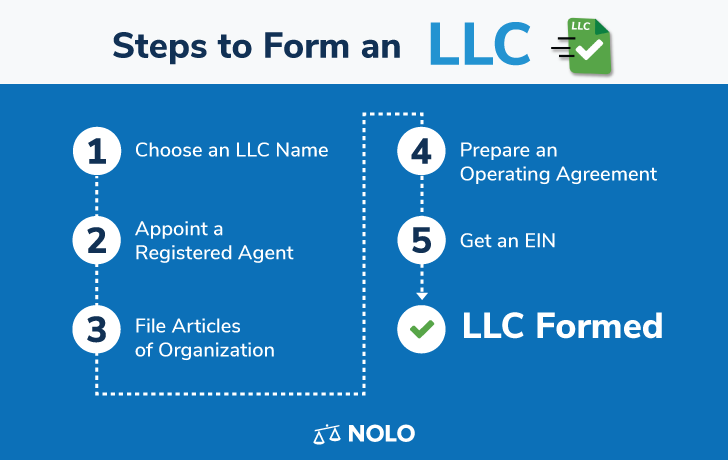

The focus is on both profit and mission alignment. The benefit report must be shared with shareholders made available to the public and be filed with the State Department unless not mandated. In order to register a business as a Benefit corporation Articles of Incorporation sometimes called a Certificate of Incorporation must be filed with the state and the necessary filing fees paid.

Our not-for-profit attorneys are committed to protecting our clients. Each attachment page 050. Filing Fee 5000 Shareholders or Members AmendmentRestatementCorrectio n Domestic Amended Amended 1 Domestic for Profit 2 Domestic Nonprofit The Ohio Secretary of State Central Ohio.

As a result they do not qualify for tax-exempt status despite their nonprofit orientation. A benefit corporation preserves a companys mission in the following ways. P Public benefit corporation means a corporation that is recognized as exempt from federal income taxation under section 501c3 of the Internal Revenue Code of 1986 100 Stat.

1 Filing Annual Reports The benefit corporation statute requires that businesses incorporated as benefit corporations must assess their operations against a third-party standard and prepare an annual report. Public Law 86-272 Corporations not filing a combined report and who meet the protections of Public Law 86272 are exempt from state taxes based upon or measured by net income. A mutual benefit corporation is a corporation typically formed to serve a limited number of members.

However they still are subject to the annual minimum franchise tax if they are doing business in incorporated in or qualified to transact intrastate business in California. Articles in such manner that it will cease to be a public benefit corporation. Without the general public benefit purpose a corporation could name a single narrow specific public benefit purpose eg.

Nonprofit Public Benefit Corporation IMPORTANT Read Instructions before completing this form. Each state will have its own process on how filings. A public benefit corporation is a corporation formed to benefit the general public.

Federal Tax Obligations of Non-Profit Corporations. Introduces capital increases and management modifications. A nonprofit corporation that does not have an exempt determination or acknowledgment letter from us is subject to the same franchise or income tax laws as any for-profit corporation.

Keeping the river in back of the factory clean from toxic effluents and then consider and dismiss all other non-financial interests when making decisions which would not meet the primary objective of this legislation to create a new corporate form whose corporate purpose requires it to. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. A public benefit corporation is a corporation created specifically to benefit the public in some way.

To be tax exempt most organizations must apply for recognition of. Some states require all benefit corporations to have a benefit director. It must file Form 100 California Corporation Franchise or Income Tax Return with us and pay at least the minimum franchise tax each year until it formally dissolves through SOS.

So just like a traditional for-profit corporation a benefit corporation is an independent legal and tax entity separate from the people who own control and manage it. Filing Fee - 3000 Copy Fees First page 100. Section 7-101-503 2 CRS defines public benefit as one or more positive effects or reduction of negative effects on one or more categories of persons entities communities or interests other than shareholders in their capacities as shareholders including effects of an artistic charitable cultural economic educational environmental literary medical religious scientific or technological nature.

Because of this separate status the owners of a benefit corporation dont use their personal tax returns to pay tax on corporate profits - the corporation itself pays these taxes. Beneschs Not-for-Profit Team assists not-for-profit and tax-exempt clients in a broad array of matters ranging from filing for nonprofit status and preparing federal and state tax exemption applications to training in not-for-profit regulatory compliance. A separate California Franchise Tax Board application is required to obtain tax.

Currently 27 states permit the formation of Benefit corporations. If you formed as a mutual benefit corporation in error please file an amendment to your Articles of.

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

How Corporations Are Taxed Nolo

Publication 908 02 2021 Bankruptcy Tax Guide Internal Revenue Service

Pin On Dcarsoncpa Mfc Lines For Cross Sector Support On Entity Needs

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Llc In Pennsylvania How To Form An Llc In Pennsylvania Nolo

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

15 Key Steps To Set Up A Charity

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Nonprofit Limited Liability Company Nonprofit Law Blog

When You Launch A Non Profit Do You File It As A C Corp Or An S Corp Quora

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

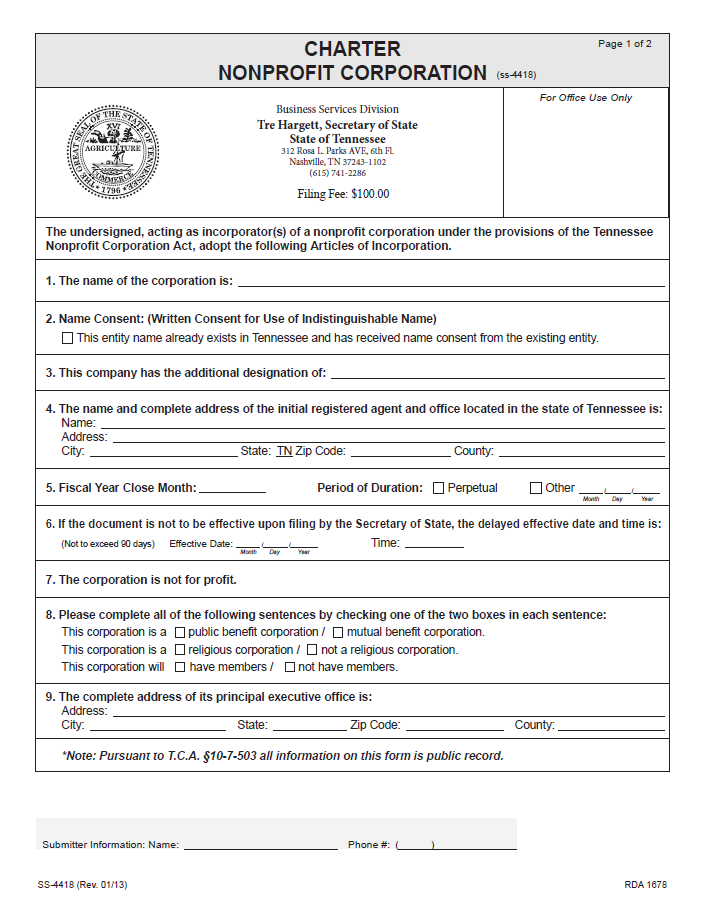

Free Tennessee Articles Of Incorporation Charter Nonprofit Corporation Form Ss 4418

Post a Comment for "Public Benefit Corporation Tax Filing"